WECOME TO SMART FINANCIAL TRAINING AND CONSULTANCY

Mail Us [email protected]

Call Us +91 8530392020

Mail Us [email protected]

Call Us +91 8530392020

We offer customized and targated professional training programs that are designed to suit the needs of any organization and indivudual.

Learn and Earn starting salary Rs. 15000/- to Rs. 25000/- Per Month

SMART Financial Training & consultancy is one of the best stock market training institutes out there in Pune. We teach how to invest your money in stocks wisely. We have established our institute with one mission & that is to educate & create awareness about stock market investing in India & help you build your wealth in the Short term & Long term. The reason above statement is our mission is because in India people participation in the stock market is very low. There are multiple reasons why people generally are reluctant to invest in stocks, like lack of awareness about stock investing, lack of knowledge, considering stock investment very risky, those who lost money they advise others not to invest in stocks etc. so these are some of the reasons why people participation in the stock market is very low in India compared to developed countries. Only less than 2% population of India is invested in securities, compared to other develop countries. We particularly teach an investing method called value investing. That is our niche.

We have designed our Course curriculum keeping the common man in our mind so that it will. The syllabus is more practical oriented, which teaches you how to trade in Stock Market Confidently. During the trading classes, you will get to learn in an interactive classroom where we actually do trading in live Stock Market and teach trading to the Participants. This will act as a confidence booster to the Participant which will make them trade in future with confidence without any fear or doubts. This training program is driven the core objective of providing quality & in-depth insight of the Stock Market & trading. Moreover, we offer repetitive learning access that means in spite of extensive training &complete Knowledge if someone feels that still he/she is not confident or market ready then you can repeat the classes in the same fees. We will also promise lifetime support after completion of course.

Learn & earn daily 1000 to 5000 guarantees with effective Risk & Money Management.

We not only make you aware & knowledgeable about share trading but also will make you the expert who can trade confidently in share market on his own.

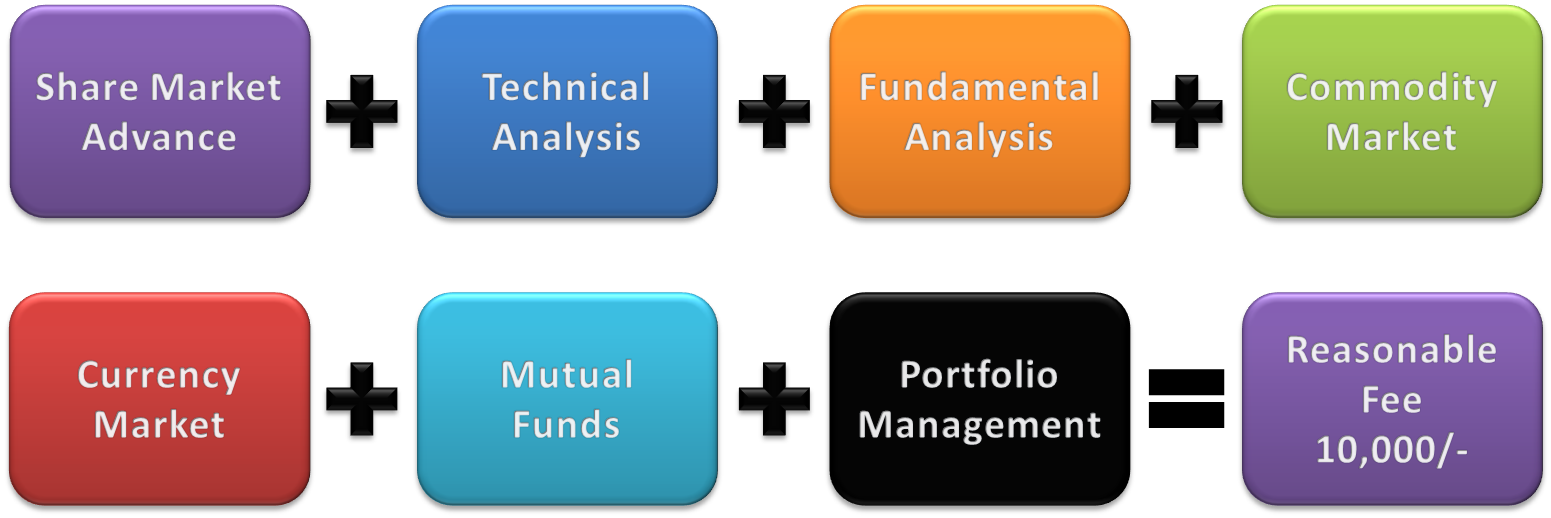

This course is a complete advanced career-oriented one with an intention to bring high-quality stocks & Commodity trading training at affordable costs. So we have deliberately kept very affordable fees with intention of making more and more common people aware about share market. Share Market Basic + Share Market Advance + Technical Analysis + Fundamental Analysis + Commodity Market + Currency Market+ Mutual Fund + Portfolio Management All IN ONE COURSE.

Mr. Ajay Pande (Trainer & Technical Analyst – Stock Market, F&O, Commodity & Currency Market)

He is focused & result oriented stock market analyst and trainer who believe in value, quality, relationship & integrity.

He is a highly motivated share trading professional who trains a student with enthusiasm and with own tips and tricks about share market trading.

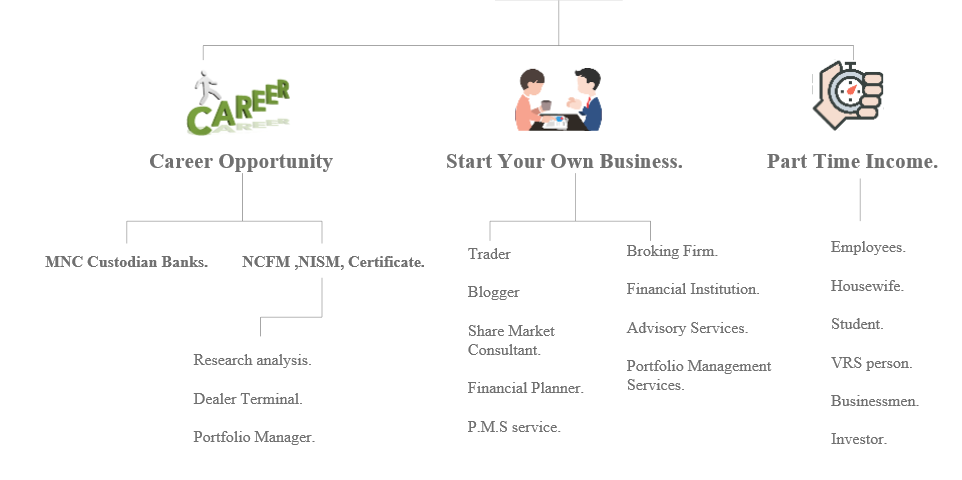

Our courses are widely attended by people from a different background including...

Batches will start from every month of 10th

Classroom training & Online training both are available

Daily & Weekend batches available

10 Days Theory + Practical with Hand-Holding support